Thule wrote:fortinbras wrote: It was inflation-proof only to the extent that the inflation was built-in from the beginning; BVN was selling the drachma at almost twice the market price for the silver content, and when the price of silver rose to approach his selling price, he doubled his price to stay ahead of the price of silver.

Yeah, but it's inflation you can

understand. It's the Nothausian school of echonomy. No big words like "market", "monetary supply" or "backin". Nothausian inflation has one single cause; Bernie needs pot-money.

[rant="Layman with only one year of real high school"]

Actually, it's double-inflation. First, you have the inflated price ($10 of silver sold for $20) but then there's the potential "stepping down." When the price of silver drops, Bernie asks people to send back their Libbies to get re-stamped for a fee (which I believed Bernie admitted happened at least once with the Libbies). This means that where you used to be able to use just one Libby (which you paid $20) to purchase a DVD, you suddenly must now have two ($20s stepped down to $10) to purchase that same DVD (and since the Libby doesn't make more than a few increments, your change would come back in USD). $40 for a $20 product. Sounds like inflation to me.

And when you really think about it, the Libbies don't even cancel out the $'s inflation because he's using the spot price of silver

in dollars as a value for his currency. Granted, the spot price of silver is probably based more on supply and demand than inflation, but inflation must play a part in the price since the currency its valued in inflates. In my mind, it's possible that the spot price of silver could (over the next ten years) fail to meet the $50 "step up" requirements due to a combination of a decrease in value and inflation. This would mean that while the price on the DVD would go up over $20, my Libby would remain at $20 and I would need two $20 Libbies to buy that DVD when before I'd only need one.

Now, if he had made up an independent system by saying that an ounce of silver is equal to 10 Libbies and made many different increments of currency each containing the appropriate amount of silver and had participating merchants list both the $ and the Libby price then he'd at least be able to truthfully say he was independent of the dollar. But he didn't do that,so either this self-proclaimed monetary genius didn't see the inherent flaw in his "We're goin' off the dollar!" plan, or he's a bold faced liar.

I still find it funny that if the dollar collapses as IIRC he predicted it would, the spot price of silver in dollars would go down to $0 which makes his Libbies only worth the silver that's in them - which is likely going to be less than what you paid for them and certainly won't be worth the face value because they're denoted in USD which is $0. Would he have asked everyone for their Libbies back and re-stamped them with a different currency designation then? Is it suddenly going to be an "inflation-proof" alternative to the euro or the yuan? [/rant]

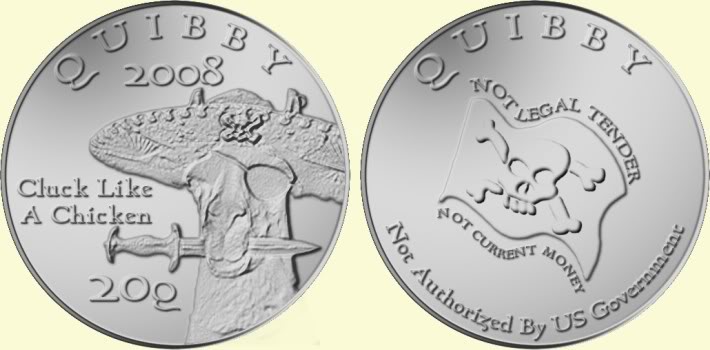

That's why everyone needs to invest in Quibbies:

Now

that's an inflation proof currency!

When chosen for jury duty, tell the judge "fortune cookie says guilty" - A fortune cookie