Well, I'm rapidly approaching semi-retirement & was looking at getting a couple of BTL's, getting them free would be a bonus.

Michael (of Bernicia) Waugh, UK bankster-buster

Moderator: ArthurWankspittle

-

hucknallred

- Admiral of the Quatloosian Seas

- Posts: 1103

- Joined: Fri Jul 03, 2015 3:34 pm

Re: Michael (of Bernicia) Waugh, UK bankster-buster

-

Gregg

- Conde de Quatloo

- Posts: 5631

- Joined: Fri May 21, 2004 5:08 am

- Location: Der Dachshundbünker

Re: Michael (of Bernicia) Waugh, UK bankster-buster

I'ma just gonna sign up for all the e-mail address volunteers stuff, and let the list of suckers come to me. Whenever I feel the need for a new supply of rations for the Dachshunds, I'll just blast my new email list for ''donations for the troops" or something. You would be amazed how much pupperoni it takes to outfit a Regiment of Assault Dachshunds.

Supreme Commander of The Imperial Illuminati Air Force

Your concern is duly noted, filed, folded, stamped, sealed with wax and affixed with a thumbprint in red ink, forgotten, recalled, considered, reconsidered, appealed, denied and quietly ignored.

Your concern is duly noted, filed, folded, stamped, sealed with wax and affixed with a thumbprint in red ink, forgotten, recalled, considered, reconsidered, appealed, denied and quietly ignored.

-

John Uskglass

- Admiral of the Quatloosian Seas

- Posts: 1074

- Joined: Wed Jan 25, 2017 1:21 pm

Re: Michael (of Bernicia) Waugh, UK bankster-buster

I'm not an expert, but it looks very peculiar indeed. The £4M is supposedly money that the company owes to other parties, but the level of funds passing through it, and the stated assets according to the accounts are such that it seems inconceivable that it represents any genuine transaction. Assuming for the moment that the £4M is in some way illegitimate (and of course I could be wrong, and there's an innocent explanation), what I can't get my head round is what the purpose of this is. I can only think that there must be some other entity somewhere whose books show that it is owed £4M, but presumably the slightest examination of that entity would show that the money is basically imaginary. Could this have something to do with 'promissory notes'?Crikey, the accounts for that company look 'interesting', a net deficit of over £4 million ....

Perhaps someone more clued up than me would like to take a peek and see what they think. I'm conscious that I may be barking up completely the wrong tree.

-

mufc1959

- Admiral of the Quatloosian Seas

- Posts: 1186

- Joined: Sun Feb 08, 2015 2:47 pm

- Location: Manchester by day, Slaithwaite by night

Re: Michael (of Bernicia) Waugh, UK bankster-buster

John Uskglass wrote: ↑Mon Jul 29, 2019 7:13 pm

I'm not an expert, but it looks very peculiar indeed. The £4M is supposedly money that the company owes to other parties, but the level of funds passing through it, and the stated assets according to the accounts are such that it seems inconceivable that it represents any genuine transaction. Assuming for the moment that the £4M is in some way illegitimate (and of course I could be wrong, and there's an innocent explanation), what I can't get my head round is what the purpose of this is. I can only think that there must be some other entity somewhere whose books show that it is owed £4M, but presumably the slightest examination of that entity would show that the money is basically imaginary. Could this have something to do with 'promissory notes'?

Perhaps someone more clued up than me would like to take a peek and see what they think. I'm conscious that I may be barking up completely the wrong tree.

Yes, I agree it all looks very odd. Within the space of a year the company has apparently run up debts of £3.5 million since the previous year, when the deficit was about £500,000. Without seeing the full accounts to ascertain what kind of turnover, acquisitions, appreciation/depreciation, expenses, salaries, etc. have been going on, it seems unlikely that it the £4 million total loss is reflective of any actual corporate activity. Or it could just mean that everything Waugh touches really does turn to shit very, very quickly.

-

mufc1959

- Admiral of the Quatloosian Seas

- Posts: 1186

- Joined: Sun Feb 08, 2015 2:47 pm

- Location: Manchester by day, Slaithwaite by night

Re: Michael (of Bernicia) Waugh, UK bankster-buster

Oh, and the process for making a claim to the Land Registry is approximately as follows:

- the claim is made to the LR, with evidence in support;

- the LR informs interested parties (such as mortgagees), who have the opportunity to object;

- it's all investigated;

- if the LR agrees there's been a mistake, it'll rectify the mistake, if this can be done;

- if rectification isn't possible (for example, if any dodgy transaction can't be unwound for some reason), then it'll look to indemnify the applicant for financial loss and actual expenses incurred in bringing the application to rectify the register.

But if the LR doesn't think it's made a mistake, then it has to be sorted out in court. This would be by way of an application to the Land Registration division of the Property Chamber (First-tier Tribunal). If that doesn't succeed, it can be appealed (with leave) to the Upper Tribunal.

But this is on a case-by-case basis, with every application requiring the applicant to provide actual evidence in support of their own individual mortgage, rather than sending the LR links to Simon Goldberg's "You and Your Cash" website and a DVD of TGBMS.

- the claim is made to the LR, with evidence in support;

- the LR informs interested parties (such as mortgagees), who have the opportunity to object;

- it's all investigated;

- if the LR agrees there's been a mistake, it'll rectify the mistake, if this can be done;

- if rectification isn't possible (for example, if any dodgy transaction can't be unwound for some reason), then it'll look to indemnify the applicant for financial loss and actual expenses incurred in bringing the application to rectify the register.

But if the LR doesn't think it's made a mistake, then it has to be sorted out in court. This would be by way of an application to the Land Registration division of the Property Chamber (First-tier Tribunal). If that doesn't succeed, it can be appealed (with leave) to the Upper Tribunal.

But this is on a case-by-case basis, with every application requiring the applicant to provide actual evidence in support of their own individual mortgage, rather than sending the LR links to Simon Goldberg's "You and Your Cash" website and a DVD of TGBMS.

-

Footloose52

- Admiral of the Quatloosian Seas

- Posts: 305

- Joined: Wed Jul 22, 2015 6:03 pm

- Location: No longer on a train

Re: Michael (of Bernicia) Waugh, UK bankster-buster

There certainly isn't a link via the directors to another company that is active. Nor is the company a subsidiary.John Uskglass wrote: ↑Mon Jul 29, 2019 7:13 pmI'm not an expert, but it looks very peculiar indeed. The £4M is supposedly money that the company owes to other parties, but the level of funds passing through it, and the stated assets according to the accounts are such that it seems inconceivable that it represents any genuine transaction. Assuming for the moment that the £4M is in some way illegitimate (and of course I could be wrong, and there's an innocent explanation), what I can't get my head round is what the purpose of this is. I can only think that there must be some other entity somewhere whose books show that it is owed £4M, but presumably the slightest examination of that entity would show that the money is basically imaginary. Could this have something to do with 'promissory notes'?Crikey, the accounts for that company look 'interesting', a net deficit of over £4 million ....

Perhaps someone more clued up than me would like to take a peek and see what they think. I'm conscious that I may be barking up completely the wrong tree.

Without seeing the full accounts that suggests the debt is to an 'outside' organisation or individual. Given the filing was micro accounts then it must meet two of the three following criteria: 1.turnover must be less than £632k a year, 2. it has less than 10 employees and 3.it has less than £316k on its balance sheet.

Both directors have the same home address in Newcastle (I found it very easily but I am not going to post it). The London address is a mailbox address (there are over a thousand companies registered there), not a trading address.

-

notorial dissent

- A Balthazar of Quatloosian Truth

- Posts: 13806

- Joined: Mon Jul 04, 2005 7:17 pm

Re: Michael (of Bernicia) Waugh, UK bankster-buster

All I can see is that AFP was set up in Oct 2015 by Waugh with no actual value and 1 share. That share was subscribed to by BTC Management Ltd., a Seychelles corp? It was set up for "Motion picture production activities" . The debt the company is holding does not make sense in any way I can see, and with Waugh on the board I can't see it as anything other than a scam of some kind.

The fact that you sincerely and wholeheartedly believe that the “Law of Gravity” is unconstitutional and a violation of your sovereign rights, does not absolve you of adherence to it.

-

TheNewSaint

- Admiral of the Quatloosian Seas

- Posts: 1678

- Joined: Sun Mar 27, 2016 9:35 am

Re: Michael (of Bernicia) Waugh, UK bankster-buster

Is it possible Waugh borrowed £4 million to finance his stupid movie, and this is his way of tracking it?

-

hucknallred

- Admiral of the Quatloosian Seas

- Posts: 1103

- Joined: Fri Jul 03, 2015 3:34 pm

Re: Michael (of Bernicia) Waugh, UK bankster-buster

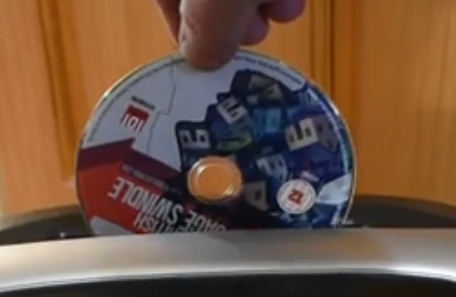

That movie could have been financed with £40.TheNewSaint wrote: ↑Tue Jul 30, 2019 11:26 am Is it possible Waugh borrowed £4 million to finance his stupid movie, and this is his way of tracking it?

However, getting actual DVD's produced must have been quite an investment, but not to the tune of £4m.

It rather sums up his business accumen. Releasing a DVD when nobody buys DVD's anymore & streaming is the thing. Did he not notice Blockbuster going bust?

So, what does it cost to produce an actual DVD, there must be a minimum number you can get mastered. Having had a copy of TGBMS in my hands, I can confirm it is a pucker DVD not a DVD-R knocked up by a mate.

-

SteveD

- Scalawag

- Posts: 67

- Joined: Fri Feb 08, 2019 3:42 am

Re: Michael (of Bernicia) Waugh, UK bankster-buster

I wouldn't be so sure, that looks suspiciously like the printable DVD's I used a few years back- the white background rather than the silver commonly found in 'proper' commercial runs is the giveaway...hucknallred wrote: ↑Tue Jul 30, 2019 12:10 pm So, what does it cost to produce an actual DVD, there must be a minimum number you can get mastered. Having had a copy of TGBMS in my hands, I can confirm it is a pucker DVD not a DVD-R knocked up by a mate.

These...

All you needed was a canon printer with the cd/dvd tray

-

ArthurWankspittle

- Slavering Minister of Auto-erotic Insinuation

- Posts: 3759

- Joined: Thu Sep 30, 2010 9:35 am

- Location: Quatloos Immigration Control

Re: Michael (of Bernicia) Waugh, UK bankster-buster

No way would even the greatest of idiots spend £4m on a movie and no money on screening it. I was wondering if this is just some left over off-the-shelf company from previous film making accounting juggling, but then the dates and form don't make sense. But then a £4m genuinely usable loss could have some considerable value, and a made up £4m loss will have zero value when the tax man checks.TheNewSaint wrote: ↑Tue Jul 30, 2019 11:26 am Is it possible Waugh borrowed £4 million to finance his stupid movie, and this is his way of tracking it?

"There is something about true madness that goes beyond mere eccentricity." Will Self

-

notorial dissent

- A Balthazar of Quatloosian Truth

- Posts: 13806

- Joined: Mon Jul 04, 2005 7:17 pm

Re: Michael (of Bernicia) Waugh, UK bankster-buster

I still think he is playing with imaginary money. I suspect the only real debt on that balance sheet is the £20K listed ahead of the £400K which I think is fantasy.

The fact that you sincerely and wholeheartedly believe that the “Law of Gravity” is unconstitutional and a violation of your sovereign rights, does not absolve you of adherence to it.

-

hucknallred

- Admiral of the Quatloosian Seas

- Posts: 1103

- Joined: Fri Jul 03, 2015 3:34 pm

Re: Michael (of Bernicia) Waugh, UK bankster-buster

Trust me, it was real, not printed. A real production company was credited on the sleeve, it had a valid barcode etc.

-

TheNewSaint

- Admiral of the Quatloosian Seas

- Posts: 1678

- Joined: Sun Mar 27, 2016 9:35 am

Re: Michael (of Bernicia) Waugh, UK bankster-buster

ArthurWankspittle wrote: ↑Tue Jul 30, 2019 12:38 pm No way would even the greatest of idiots spend £4m on a movie and no money on screening it.

None of you have seen The Producers?

Hey, it would explain a lot: the years spent making and promoting a movie that has zero audience; the endless cancelled screenings; undermining ticket sales by releasing it on DVD the same time it was in the theater; the suspicious motion picture company with £4 million invested and hardly any expenditures; and the lawsuits that couldn't possibly go anywhere. The activism would just be addtional window dressing for the long con.

It kinda makes sense.

-

John Uskglass

- Admiral of the Quatloosian Seas

- Posts: 1074

- Joined: Wed Jan 25, 2017 1:21 pm

Re: Michael (of Bernicia) Waugh, UK bankster-buster

MoB is hardly one to refrain from blowing his own trumpet, so it is curious that, afaik, he's never boasted of having done four million quids worth of whatever the feck he's doing.

-

Siegfried Shrink

- Admiral of the Quatloosian Seas

- Posts: 1848

- Joined: Fri May 26, 2017 9:29 pm

- Location: West Midlands, England

Re: Michael (of Bernicia) Waugh, UK bankster-buster

Was 4 million about the total amount the Bank of Scotland were after him for?

-

SoLongCeylon

- Admiral of the Quatloosian Seas

- Posts: 285

- Joined: Mon Jun 22, 2015 6:25 am

Re: Michael (of Bernicia) Waugh, UK bankster-buster

If you join one of the action groups, you get sent this to fill in :

{ no doubt, upon receipt, the LR will send a cheque to you without delay. It would be interesting to know if the LR are aware of all of this and what they intend to do }

STATEMENT OF CLAIM FOR COMPENSATION

Dear Land Registrar,

Re: [Add address and/or title number of the property concerned].

Please administer this Statement of Claim for Compensation, to which I am entitled under Schedule 9 of the Land Registration Act (Northern Ireland) 1970, for the following reasons [without limitation].

1. On [add date], a mortgage for monies of £[add principal] was agreed with a broker for [add mortgage company's name] in [add place], at an interest rate of [add interest rate]% for 25 years, for the purposes of buying the above referenced property.

2. However, I signed the mortgage offer letter and then the mortgage deed, without an independent witness attesting to my signature at the moment of execution; and before I owned the property concerned, in order to receive the purported loan of monies to purchase it.

3. I now know that this rendered the mortgage illegal and void in the absence of valid attestation to the signature by an independent witness, under section 3 of The Law Reform (Miscellaneous Provisions) (Northern Ireland) Order 2005.

4. It also flies in the face of the binding Supreme Court decision in Scott v Southern Pacific Mortgages [2014] - – no proprietory interest, whether legal or equitable, arises until completion of the purchase of a property.

5. Nevertheless, as the register shows, the property is/was legally owned by myself from [add date of completion] to [add date sale, if any] and that a legal mortgage has been illegally registered in favour of [add name of mortgagee].

6. This entry is a mistake, on the grounds that:

a. The registered deed is/was illegal and void under the section 3 of The Law Reform (Miscellaneous Provisions) (Northern Ireland) Order 2005; and/or

b. The registered deed is/was signed by the mortgagor before the legal or equitable right to do so arose, as per the binding Supreme Court decision in Scott v Southern Pacific Mortgages [2014]; and/or

9. c. There is/was no existing mortgage contract containing all of the terms and conditions in a single document, signed by both the mortgagor and the mortgagee, which also breaches sections 43 and 44 of the Companies Act 2006, which legally oblige mortgage companies to sign mortgage contracts.

10. I am therefore making a concurrent application to rectify the register under Part VIII of the Land Registration Act (Northern Ireland) 1970., for the purposes of cancelling a mistakenly registered illegal mortgage deed, on the grounds stated in the foregoing.

11. I am entitled to indemnification for any and all losses that I have incurred because the register was rectified to record an illegal mortgage in my name, under Rule 74 of the NI Land Registry Rules; and I am not required to prove who was responsible for this mistake in the register to qualify for such indemnity, only that such losses were a direct result of the rectification of the register, which is self-evident in this case.

12. The current total of my losses is £[add losses total], which is the sum I require in compensation as of today's date, to put me back in the position I would have been in, had the register not been rectified to record a plainly illegal mortgage as a legal charge.

13. This claim for compensation is made under section 83(2) of the Land Registration Act (Northern Ireland) 1970.

Please let me know what you require, if anything, to administer this claim for indemnity.

A Schedule of Losses will follow in due course.

Yours faithfully,

Void Mortgagor

{ no doubt, upon receipt, the LR will send a cheque to you without delay. It would be interesting to know if the LR are aware of all of this and what they intend to do }

STATEMENT OF CLAIM FOR COMPENSATION

Dear Land Registrar,

Re: [Add address and/or title number of the property concerned].

Please administer this Statement of Claim for Compensation, to which I am entitled under Schedule 9 of the Land Registration Act (Northern Ireland) 1970, for the following reasons [without limitation].

1. On [add date], a mortgage for monies of £[add principal] was agreed with a broker for [add mortgage company's name] in [add place], at an interest rate of [add interest rate]% for 25 years, for the purposes of buying the above referenced property.

2. However, I signed the mortgage offer letter and then the mortgage deed, without an independent witness attesting to my signature at the moment of execution; and before I owned the property concerned, in order to receive the purported loan of monies to purchase it.

3. I now know that this rendered the mortgage illegal and void in the absence of valid attestation to the signature by an independent witness, under section 3 of The Law Reform (Miscellaneous Provisions) (Northern Ireland) Order 2005.

4. It also flies in the face of the binding Supreme Court decision in Scott v Southern Pacific Mortgages [2014] - – no proprietory interest, whether legal or equitable, arises until completion of the purchase of a property.

5. Nevertheless, as the register shows, the property is/was legally owned by myself from [add date of completion] to [add date sale, if any] and that a legal mortgage has been illegally registered in favour of [add name of mortgagee].

6. This entry is a mistake, on the grounds that:

a. The registered deed is/was illegal and void under the section 3 of The Law Reform (Miscellaneous Provisions) (Northern Ireland) Order 2005; and/or

b. The registered deed is/was signed by the mortgagor before the legal or equitable right to do so arose, as per the binding Supreme Court decision in Scott v Southern Pacific Mortgages [2014]; and/or

9. c. There is/was no existing mortgage contract containing all of the terms and conditions in a single document, signed by both the mortgagor and the mortgagee, which also breaches sections 43 and 44 of the Companies Act 2006, which legally oblige mortgage companies to sign mortgage contracts.

10. I am therefore making a concurrent application to rectify the register under Part VIII of the Land Registration Act (Northern Ireland) 1970., for the purposes of cancelling a mistakenly registered illegal mortgage deed, on the grounds stated in the foregoing.

11. I am entitled to indemnification for any and all losses that I have incurred because the register was rectified to record an illegal mortgage in my name, under Rule 74 of the NI Land Registry Rules; and I am not required to prove who was responsible for this mistake in the register to qualify for such indemnity, only that such losses were a direct result of the rectification of the register, which is self-evident in this case.

12. The current total of my losses is £[add losses total], which is the sum I require in compensation as of today's date, to put me back in the position I would have been in, had the register not been rectified to record a plainly illegal mortgage as a legal charge.

13. This claim for compensation is made under section 83(2) of the Land Registration Act (Northern Ireland) 1970.

Please let me know what you require, if anything, to administer this claim for indemnity.

A Schedule of Losses will follow in due course.

Yours faithfully,

Void Mortgagor

-

SoLongCeylon

- Admiral of the Quatloosian Seas

- Posts: 285

- Joined: Mon Jun 22, 2015 6:25 am

Re: Michael (of Bernicia) Waugh, UK bankster-buster

and you get sent this:

IN THE HIGH COURT OF JUSTICE

CHANCERY DIVISION

[ADD DISTRICT REGISTRY]

CLAIM NUMBER:

[ADD NAMES OF CLAIMANTS] [THE CLAIMANTS]

V

[ADD NAMES OF ALL UK MORTGAGEES] [THE DEFENDANTS]

______________________________________________________________________________

STATEMENT OF CASE

______________________________________________________________________________

This is a Statement of Case in support of the above referenced representative claim of mortgage fraud, made by the Claimants under CPR Part 19 in England and Wales [in Scotland, under the Civil Litigation (Expenses and Group Proceedings) (Scotland) Act 2018 and in Northern Ireland, under Order 15 of the Court Rules;], for and on behalf of every mortgagor with the same claim, against every UK mortgage company that trades [or has traded] within England and Wales [Scotland or Northern Ireland].

THE FACTS

1. The Claimants were all, subsequent the enactment of the Law of Property (Miscellaneous Provisions) act 1989 in England and Wales, offered mortgage loans by the Defendants, which the latter presented to them in the form of Mortgage Offer and Acceptance Letters [Exhibit A].

2. The Claimants then signed and returned the letters to the Defendants, as instructed by their mortgage brokers; or they simply did nothing and waited for further instructions.

3. Upon the instructions of the mortgagee, the Claimants then engaged the services of conveyancing solicitors, who illegally advised them to do both of the following things:

a. Sign the mortgage deed in favour of the mortgagee, before they owned the property concerned, in order to receive the mortgage monies offered and complete the purchase.

b. Sign the mortgage deed without dating it, before returning it to their solicitors [Exhibit B – Solicitors' Letters].

4. Each of the Claimants signed the deed before the completion date of their purchase, without an independent witness being present at the moment of execution and attesting to the signature; or in the presence of a conveyancing solicitor, who had a conflict of interest in the transaction and is incapable of being considered independent [Exhibit C – Mortgage Deeds].

5. The conveyancing solicitors proceeded to register the deeds as legal mortgages in the Charges Register, but not before adding the dates of the completions of the purchases of the properties concerned, where the dates of execution should have been written [Exhibit D – Office Copy Entries from Land Registry].

6. It must also be stressed that none of the Claimants has ever been presented with any form of mortgage contract that was signed by both the mortgagor and the mortgagee, containing all of its terms and conditions in a single document.

7. Furthermore, it is only very recently that the Claimants became aware that these facts render each mortgage transaction illegal, void and fraudulent, on the grounds that the mortgage documents fall foul of both section 1 and section 2 of the 1989 Act and contain plainly dishonest statements regarding their legal validity.

THE SECTION 1 POINT

8. As was firmly established in Lord Neuberger's decision in Helden v Strathmore [2011], in England and Wales, section 1 of the Law of Property (Miscellaneous Provisions) Act 1989 applies to mortgage deeds, whilst section 2 of the 1989 Act applies to mortgage contracts.

9. The applicability of the 1989 Act was affirmed in Bank of Scotland v Waugh & Others [2014], when HHJ Behrens ruled that a mortgagor is not estopped from arguing that a mortgage deed is void, if the signature of the mortgagor is not attested to by an independent witness at the moment of execution, as per section 1(3) of the 1989 Act.

10. Section 1(3) of the 1989 Act prescribes that a mortgage deed must be signed by the mortgagor in the presence of an independent witness, who must attest the signature, to be properly made and delivered as a deed, otherwise it will be void under section 52(1) of the Law of Property Act 1925, as per Bank of Scotland plc v Waugh & Others [2014].

11. None of the Claimants signed their mortgage deeds in the presence of an independent witness. In fact, it appears that the signed attestations of a large proportion of the deeds may well have been forged.

12. Whilst the 1989 Act does not apply in Scotland or Northern Ireland, in Scotland, the Requirements of Writing (Scotland) Act 1995, and in Northern Ireland, section 3 of The Law Reform (Miscellaneous Provisions) (Northern Ireland) Order 2005, have the same effect as section 1(3) of the 1989 Act.

13. It is therefore averred that it is a long established principle that all UK mortgage deeds must be signed in the presence of an independent witness, who must attest the signature, otherwise the mortgagor would have no protection against the fraudulent disposition of an interest in their name.

SOUTHERN PACIFIC MORTGAGES

14. However, even in the event that the Claimants had their signatures properly attested to at the moments of execution, the deeds were all executed before they had the proprietary right to grant a legal or equitable interest over the properties concerned, when no such rights accrue to the purchaser until ownership, as per the Supreme Court decision in Scott v Southern Pacific Mortgages [2014].

15. In Southern Pacific Mortgages, a Sale and Leaseback agreement which preceded the purchase of property was held to be void and unenforceable against the purchaser, on that very ground.

16. In the event this decision is applied in this case, the effect would be to nullify the enforceability of the mortgages concerned [should it exist], on the ground that they were executed without the required proprietory rights to do so.

17. This decision is binding on all UK mortgage related proceedings.

THE SECTION 2 POINT

18. Section 2 of the 1989 Act prescribes that no mortgage or charge will arise in the absence of a single document, containing all of the terms and conditions and signed by both the mortgagor and the mortgagee, as per the decisions given in United Bank of Kuwait v Sahib & Others [1996], Murray v Guinness [1998] and Keay and Keay v Morris Homes [2012].

19. The Claimants contend that, since they have never signed any document that was also signed by the bank, containing the terms and conditions of the mortgage; and because no such documents can be adduced into evidence, there are no legally valid and enforceable mortgage contracts in existence.

20. Where section 2 of the 1989 Act does not apply in Scotland and Northern Ireland:

a. In Scotland, the Requirements of Writing (Scotland) Act 1995 also requires that written contracts must be properly executed by mortgage companies to have legal effect.

b. In Northern Ireland, sections 43 and 44 of the Companies Act 2006 legally oblige mortgage companies to sign mortgage contracts.

c. The Statute of Frauds Act 1677 also prescribes that a creditor [including a mortgage company] cannot issue legal proceedings against a debtor [including a mortgagor], unless the debt can be verified by a written agreement, which must be signed by the debtor.

ELEMENTS OF CIVIL FRAUD

21. The elements of civil fraud are as follows:

a. A party must knowingly or recklessly rely upon false statements for material gain.

b. Another party must be caused to rely on those false statements by the maker of them.

c. The party who relies on the false statements must incur losses as a result.

22. It is abundantly clear in the evidence cited, that at the very least, the Defendants and their conveyancing solicitors were reckless in relying upon plainly false mortgage documents, which were fraudulently registered.

23. The primary example of the false statements relied upon by the Claimants is that the void mortgage documents were legally binding upon them, which is stated on every mortgage deed and mortgage offer letter [Exhibit E – False Statements from Mortgage Documents].

24. Another example of a dishonest statement which applies to every mortgage deed is that the mortgagors were required by the mortgagees to sign the mortgage deeds as 'beneficial owners' of the properties concerned, prior to ownership and the receipt of the purported loans of monies they needed to acquire them.

25. It is also emphatically shown by the entry of the illegal dispositions of the void mortgages in the Charges Register that both the Claimants and the Land Registry have been caused by the actions of the Defendants to rely upon the false statements contained within the mortgage documents.

26. On the basis that the Defendants do not dispute that the Claimants have paid substantial amounts to them over the terms of their void mortgages, which is ascertained in each case by statements issued by the Defendants [Exhibit F – Bank Statements Proving Losses]; it is indisputable that the Claimants have incurred losses as a direct result of relying upon those false statements contained within the mortgage documents.

CONCLUSION

27. The Claimants are seeking a declaration that, unless the Defendants can provide valid mortgage documents within 14 days, the registered mortgages concerned must be considered capable of cancellation by the Land Registries of the United Kingdom as mistakes in the Charges Registers, upon the applications of the Claimants to do cancel them, on the grounds sustained by the evidence in support of this claim; and the Claimants are entitled to be indemnified, for the losses incurred as a direct result of these fraudulent entries in the registers.

We believe the statements contained in the foregoing are true, complete and not misleading, to the very best of our knowledge and recollection.

Signed......................................................... Signed.........................................................

[ADD NAME OF CLAIMANT] [ADD NAME OF CLAIMANT]

Date............................................................

IN THE HIGH COURT OF JUSTICE

CHANCERY DIVISION

[ADD DISTRICT REGISTRY]

CLAIM NUMBER:

[ADD NAMES OF CLAIMANTS] [THE CLAIMANTS]

V

[ADD NAMES OF ALL UK MORTGAGEES] [THE DEFENDANTS]

______________________________________________________________________________

STATEMENT OF CASE

______________________________________________________________________________

This is a Statement of Case in support of the above referenced representative claim of mortgage fraud, made by the Claimants under CPR Part 19 in England and Wales [in Scotland, under the Civil Litigation (Expenses and Group Proceedings) (Scotland) Act 2018 and in Northern Ireland, under Order 15 of the Court Rules;], for and on behalf of every mortgagor with the same claim, against every UK mortgage company that trades [or has traded] within England and Wales [Scotland or Northern Ireland].

THE FACTS

1. The Claimants were all, subsequent the enactment of the Law of Property (Miscellaneous Provisions) act 1989 in England and Wales, offered mortgage loans by the Defendants, which the latter presented to them in the form of Mortgage Offer and Acceptance Letters [Exhibit A].

2. The Claimants then signed and returned the letters to the Defendants, as instructed by their mortgage brokers; or they simply did nothing and waited for further instructions.

3. Upon the instructions of the mortgagee, the Claimants then engaged the services of conveyancing solicitors, who illegally advised them to do both of the following things:

a. Sign the mortgage deed in favour of the mortgagee, before they owned the property concerned, in order to receive the mortgage monies offered and complete the purchase.

b. Sign the mortgage deed without dating it, before returning it to their solicitors [Exhibit B – Solicitors' Letters].

4. Each of the Claimants signed the deed before the completion date of their purchase, without an independent witness being present at the moment of execution and attesting to the signature; or in the presence of a conveyancing solicitor, who had a conflict of interest in the transaction and is incapable of being considered independent [Exhibit C – Mortgage Deeds].

5. The conveyancing solicitors proceeded to register the deeds as legal mortgages in the Charges Register, but not before adding the dates of the completions of the purchases of the properties concerned, where the dates of execution should have been written [Exhibit D – Office Copy Entries from Land Registry].

6. It must also be stressed that none of the Claimants has ever been presented with any form of mortgage contract that was signed by both the mortgagor and the mortgagee, containing all of its terms and conditions in a single document.

7. Furthermore, it is only very recently that the Claimants became aware that these facts render each mortgage transaction illegal, void and fraudulent, on the grounds that the mortgage documents fall foul of both section 1 and section 2 of the 1989 Act and contain plainly dishonest statements regarding their legal validity.

THE SECTION 1 POINT

8. As was firmly established in Lord Neuberger's decision in Helden v Strathmore [2011], in England and Wales, section 1 of the Law of Property (Miscellaneous Provisions) Act 1989 applies to mortgage deeds, whilst section 2 of the 1989 Act applies to mortgage contracts.

9. The applicability of the 1989 Act was affirmed in Bank of Scotland v Waugh & Others [2014], when HHJ Behrens ruled that a mortgagor is not estopped from arguing that a mortgage deed is void, if the signature of the mortgagor is not attested to by an independent witness at the moment of execution, as per section 1(3) of the 1989 Act.

10. Section 1(3) of the 1989 Act prescribes that a mortgage deed must be signed by the mortgagor in the presence of an independent witness, who must attest the signature, to be properly made and delivered as a deed, otherwise it will be void under section 52(1) of the Law of Property Act 1925, as per Bank of Scotland plc v Waugh & Others [2014].

11. None of the Claimants signed their mortgage deeds in the presence of an independent witness. In fact, it appears that the signed attestations of a large proportion of the deeds may well have been forged.

12. Whilst the 1989 Act does not apply in Scotland or Northern Ireland, in Scotland, the Requirements of Writing (Scotland) Act 1995, and in Northern Ireland, section 3 of The Law Reform (Miscellaneous Provisions) (Northern Ireland) Order 2005, have the same effect as section 1(3) of the 1989 Act.

13. It is therefore averred that it is a long established principle that all UK mortgage deeds must be signed in the presence of an independent witness, who must attest the signature, otherwise the mortgagor would have no protection against the fraudulent disposition of an interest in their name.

SOUTHERN PACIFIC MORTGAGES

14. However, even in the event that the Claimants had their signatures properly attested to at the moments of execution, the deeds were all executed before they had the proprietary right to grant a legal or equitable interest over the properties concerned, when no such rights accrue to the purchaser until ownership, as per the Supreme Court decision in Scott v Southern Pacific Mortgages [2014].

15. In Southern Pacific Mortgages, a Sale and Leaseback agreement which preceded the purchase of property was held to be void and unenforceable against the purchaser, on that very ground.

16. In the event this decision is applied in this case, the effect would be to nullify the enforceability of the mortgages concerned [should it exist], on the ground that they were executed without the required proprietory rights to do so.

17. This decision is binding on all UK mortgage related proceedings.

THE SECTION 2 POINT

18. Section 2 of the 1989 Act prescribes that no mortgage or charge will arise in the absence of a single document, containing all of the terms and conditions and signed by both the mortgagor and the mortgagee, as per the decisions given in United Bank of Kuwait v Sahib & Others [1996], Murray v Guinness [1998] and Keay and Keay v Morris Homes [2012].

19. The Claimants contend that, since they have never signed any document that was also signed by the bank, containing the terms and conditions of the mortgage; and because no such documents can be adduced into evidence, there are no legally valid and enforceable mortgage contracts in existence.

20. Where section 2 of the 1989 Act does not apply in Scotland and Northern Ireland:

a. In Scotland, the Requirements of Writing (Scotland) Act 1995 also requires that written contracts must be properly executed by mortgage companies to have legal effect.

b. In Northern Ireland, sections 43 and 44 of the Companies Act 2006 legally oblige mortgage companies to sign mortgage contracts.

c. The Statute of Frauds Act 1677 also prescribes that a creditor [including a mortgage company] cannot issue legal proceedings against a debtor [including a mortgagor], unless the debt can be verified by a written agreement, which must be signed by the debtor.

ELEMENTS OF CIVIL FRAUD

21. The elements of civil fraud are as follows:

a. A party must knowingly or recklessly rely upon false statements for material gain.

b. Another party must be caused to rely on those false statements by the maker of them.

c. The party who relies on the false statements must incur losses as a result.

22. It is abundantly clear in the evidence cited, that at the very least, the Defendants and their conveyancing solicitors were reckless in relying upon plainly false mortgage documents, which were fraudulently registered.

23. The primary example of the false statements relied upon by the Claimants is that the void mortgage documents were legally binding upon them, which is stated on every mortgage deed and mortgage offer letter [Exhibit E – False Statements from Mortgage Documents].

24. Another example of a dishonest statement which applies to every mortgage deed is that the mortgagors were required by the mortgagees to sign the mortgage deeds as 'beneficial owners' of the properties concerned, prior to ownership and the receipt of the purported loans of monies they needed to acquire them.

25. It is also emphatically shown by the entry of the illegal dispositions of the void mortgages in the Charges Register that both the Claimants and the Land Registry have been caused by the actions of the Defendants to rely upon the false statements contained within the mortgage documents.

26. On the basis that the Defendants do not dispute that the Claimants have paid substantial amounts to them over the terms of their void mortgages, which is ascertained in each case by statements issued by the Defendants [Exhibit F – Bank Statements Proving Losses]; it is indisputable that the Claimants have incurred losses as a direct result of relying upon those false statements contained within the mortgage documents.

CONCLUSION

27. The Claimants are seeking a declaration that, unless the Defendants can provide valid mortgage documents within 14 days, the registered mortgages concerned must be considered capable of cancellation by the Land Registries of the United Kingdom as mistakes in the Charges Registers, upon the applications of the Claimants to do cancel them, on the grounds sustained by the evidence in support of this claim; and the Claimants are entitled to be indemnified, for the losses incurred as a direct result of these fraudulent entries in the registers.

We believe the statements contained in the foregoing are true, complete and not misleading, to the very best of our knowledge and recollection.

Signed......................................................... Signed.........................................................

[ADD NAME OF CLAIMANT] [ADD NAME OF CLAIMANT]

Date............................................................

-

D-C

- Scalawag

- Posts: 67

- Joined: Tue Apr 10, 2018 8:34 pm

Re: Michael (of Bernicia) Waugh, UK bankster-buster

hucknallred wrote: ↑Tue Jul 30, 2019 1:38 pmTrust me, it was real, not printed. A real production company was credited on the sleeve, it had a valid barcode etc.

The database to check barcodes is https://barcodesdatabase.org/. And to get a valid barcode from a reseller will cost you between £1 and £35

-

AnOwlCalledSage

- Admiral of the Quatloosian Seas

- Posts: 2456

- Joined: Fri Dec 15, 2017 5:56 pm

- Location: M3/S Hubble Road, Cheltenham GL51 0EX

Re: Michael (of Bernicia) Waugh, UK bankster-buster

Not withstanding any privatisation of the Land Registry operations, I think I'm right in saying you can still FOI them. Might try a request for "Please can I have the number of requests to indemnify register entries, and how many were successful?' although I might have to wait a few months to get this batch included.

But it's as I suspected. He's going to ask his narks to lie about whether their signature was witnessed.

Now I did get my mortgage signature witnessed "live" by a neighbour but there is no way Nationwide would know if I had or hadn't other than the form I submitted had a witness signature on it in the correct place.

So one way or another anyone using his pro-forma would be attempting to commit fraud. That could spell jail time rather than a free house.

But it's as I suspected. He's going to ask his narks to lie about whether their signature was witnessed.

Now I did get my mortgage signature witnessed "live" by a neighbour but there is no way Nationwide would know if I had or hadn't other than the form I submitted had a witness signature on it in the correct place.

So one way or another anyone using his pro-forma would be attempting to commit fraud. That could spell jail time rather than a free house.

Never attribute to malice what can be adequately explained by stupidity - Hanlon's Razor